Table of Content

- Reasons to Choose a 15-Year Fixed-Rate Mortgage

- Today’s Connecticut Mortgage Rates: What to Know Before Making a Connecticut Home Purchase

- What is a good 15-year refinance rate?

- Compare the 3 Best 15-year Mortgage Lenders of 2020

- How 15-Year Fixed-Rate Loans Work

- Refinance Rates for December 15, 2022

- Conforming Conventional Mortgages

- Mortgage Interest Rates by Loan Type

It’s always a good idea to ask the lender what kind of closing costs they’ll charge before you decide to borrow from them. The Fed doesn't directly control fixed mortgage rates, however — the most pertinent number is the 10-year Treasury yield. Even so, high inflation all but forces the Fed to act aggressively, and it sets the tone for rates overall.

Our advertisers are leaders in the marketplace, and they compensate us in exchange for placement of their products or services when you click on certain links posted on our site. This allows us to bring you, at no charge, quality content, competitive rates and useful tools. To have an easier time locking in a good rate, remember to shop around and compare your options from as many lenders as possible.

Reasons to Choose a 15-Year Fixed-Rate Mortgage

Conventional mortgages are types of home loans that are not directly sponsored by the government. These are usually packaged into mortgage-backed securities that are backed by Fannie Mae and Freddie Mac, the two most prominent government-sponsored entities . Conventional mortgages are provided by private banks, mortgage companies, and credit unions. Because of the COVID-19 pandemic, the world economy fell into a recession in 2020.

Since the start of the coronavirus pandemic in 2020, rates were hovering around historic lows. Now, rates are on the rise as the Federal Reserve aims to contain inflation. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices.

Today’s Connecticut Mortgage Rates: What to Know Before Making a Connecticut Home Purchase

Financial experts recommend refinancing at least 1 to 2 percent lower than your original rate. As with any financial product, though, you’ll want to take your time when comparing lenders and rates. Current 15-year mortgage rates may look favorable, but you’ll have to live with the terms of the contract for a long time. It’s always best to analyze it in context so you can confidently choose the right loan for you.

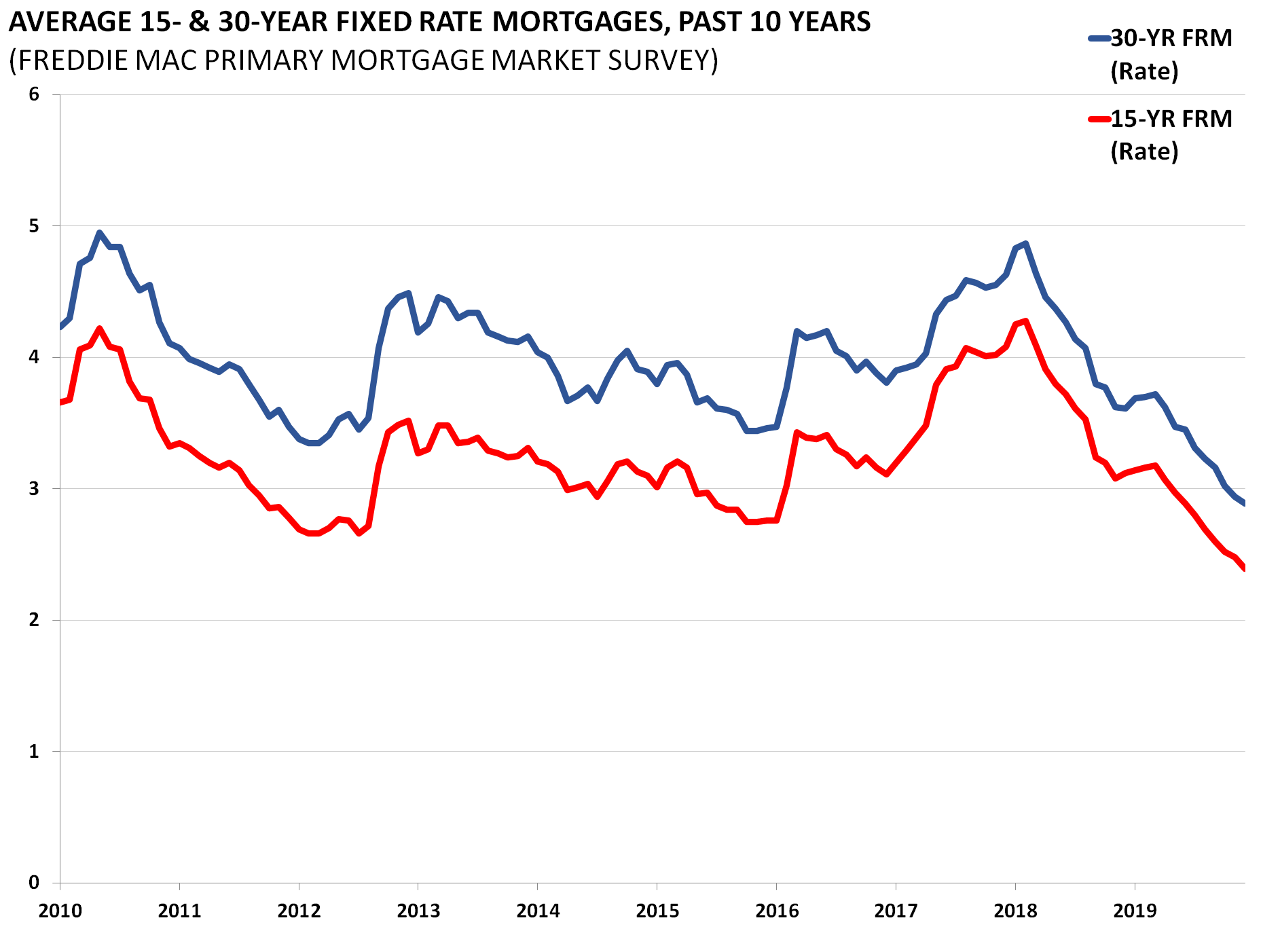

The following are some strategies that could help you secure the best possible rate on your loan. Opting for a shorter, 15-year term can help you pay off your mortgage more quickly compared to borrowers who choose longer terms. Less time to own your home – With a 15-year term, you’ll pay off your loan in half the time of the more common 30-year term loan. The opportunity cost of tying up money in home equity instead of other financial assets. Rates on 15-year loans are significantly lower than rates on 30-year loans.

What is a good 15-year refinance rate?

We used The Mortgage Reports refinance calculator to show how 15-year refinance savings might compare to a 30-year refinance. Better yet, the total amount of interest you pay will be much, much lower because you’re borrowing the same sum for half the period. Overall, rates change frequently, so when you get a rate you’re comfortable with, consider a rate lock so you won’t have to worry about it changing before you close on your loan.

The minimum down payment for a 15-year mortgage is 3%, but as with all mortgage loans, it costs you less in the long run if you put down more upfront. In the process, you’ll fully pay off your existing loan, and then start payments on a new one. The two most common kinds of mortgage refinances are rate-and-term changes — which result in a new interest rate and a reset payment clock — and cash-out refinances. Cash-out refinances allow homeowners to take advantage of their home equity by taking out a new mortgage with a larger principal based on the home’s current value.

Compare the 3 Best 15-year Mortgage Lenders of 2020

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Consolidating a 30-year mortgage into a 15-year refinance could save you money because it lowers your interest rate and reduces your loan term. Lower total cost of borrowing – Between a lower interest rate and a shorter term, you'll reduce the total interest you pay over the life of the loan. Deciding between a 15-year refi and increasing payments on your existing loan? You can use our Additional Mortgage Payment Calculator to see how extra payments will shorten your pay-off time and lower your interest costs.

Comparing as many lenders as possible can help you find a loan with optimal terms. Because payments on a 15-year loan are higher than what you’d pay with a 20- or 30-year term, you could end up with less room in your budget for unexpected expenses. Refinancing into a 15-year fixed-rate home loan may shorten your loan term, too, which will save you thousands in interest over the life of your mortgage. The rates shown above are the current rates for the refinance of a single-family primary residence based on a 45-day lock period.

We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Take a look at mortgage refinance rates for a number of different loans.

No comments:

Post a Comment