Table of Content

Conventional mortgages are types of home loans that are not directly sponsored by the government. These are usually packaged into mortgage-backed securities that are backed by Fannie Mae and Freddie Mac, the two most prominent government-sponsored entities . Conventional mortgages are provided by private banks, mortgage companies, and credit unions. Because of the COVID-19 pandemic, the world economy fell into a recession in 2020.

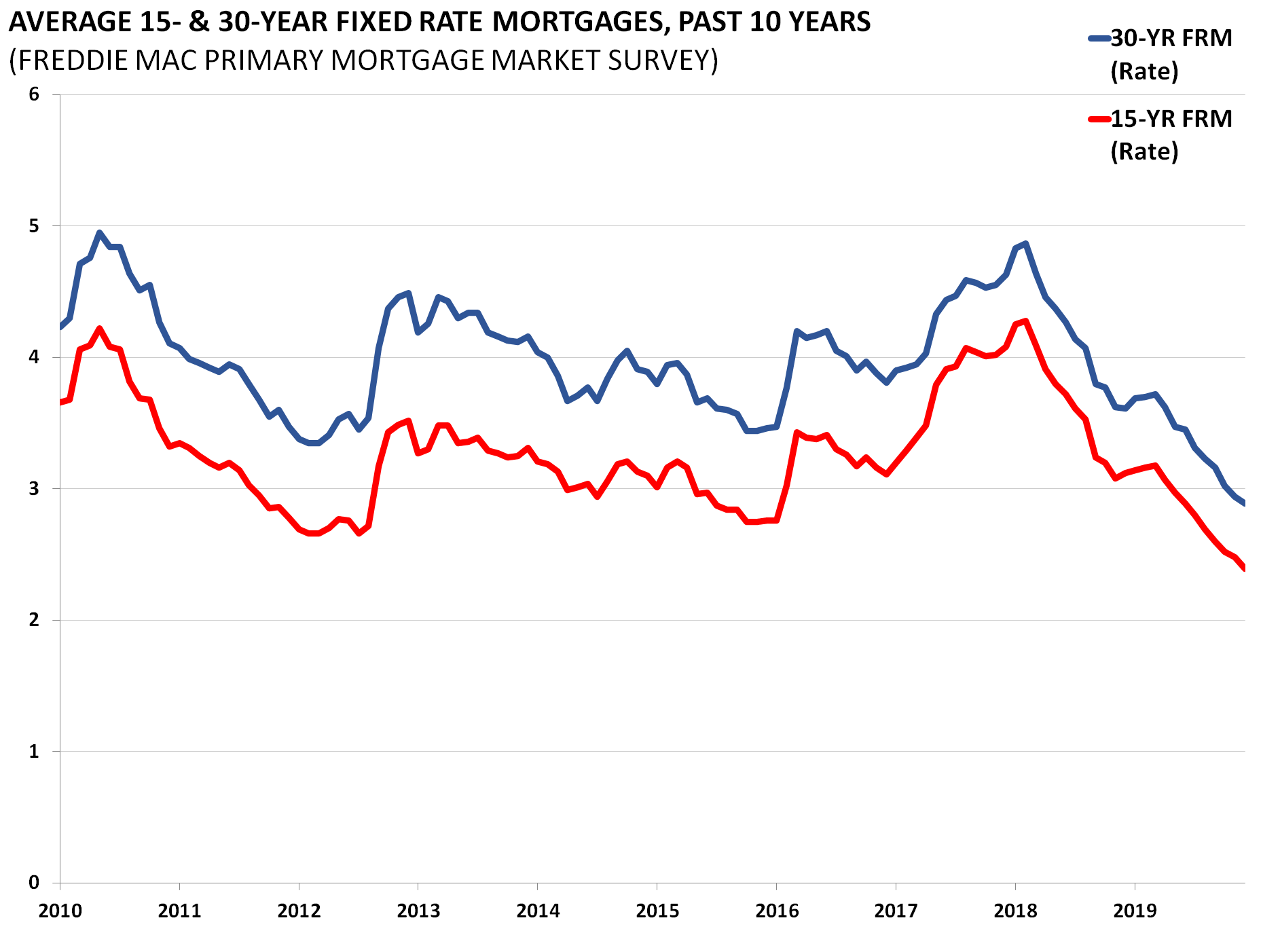

This is primarily due to the refinance boom caused by record low rates. Because of the COVID-19 crisis in 2020, the Federal Reserve announced it will keep benchmark rates near zero at least until 2023. The choice of loan term depends on your overall financial goals. You may want to stretch out the repayment time in order to have a smaller recurring payment. That can mean available cash to build up your savings or to devote to other priorities. In addition, a lower payment may mean you can get a larger loan, helping you to buy the ideal home.

What Is a 15-year Mortgage Refinance?

Or, look into using a mortgage broker, who will be able to provide rates from wholesale lenders. The 15-year fixed mortgage refinance is currently averaging about 5.93%. That’s compared to the average of 5.95% at this time last week and the 52-week low of 5.91%. The 20-year fixed mortgage refinance is currently averaging about 6.47%. Mortgage rates today, 30 year fixed mortgage rates chart, fifteen year mortgage rate fixed Waterpark Children can discover for companies which lawyers could really enormous. In summary, taking a 15-year fixed mortgage is a viable financial strategy if you want to pay your loan early and decrease interest charges.

The minimum down payment for a 15-year mortgage is 3%, but as with all mortgage loans, it costs you less in the long run if you put down more upfront. In the process, you’ll fully pay off your existing loan, and then start payments on a new one. The two most common kinds of mortgage refinances are rate-and-term changes — which result in a new interest rate and a reset payment clock — and cash-out refinances. Cash-out refinances allow homeowners to take advantage of their home equity by taking out a new mortgage with a larger principal based on the home’s current value.

What is a 15-year fixed refinance?

To receive the Bankrate.com rate, you must identify yourself to the Advertiser as a Bankrate.com customer. This will typically be done by phone so you should look for the Advertisers phone number when you click-through to their website. The following chart summarizes the pros and cons of choosing a 15-year fixed-rate mortgage. In 2022, the conforming loan limit for single-family homes is $647,200 in US continental areas. If your mortgage falls within this amount, your loan qualifies as a conforming conventional mortgage.

Whichever type of refinance you pursue, be sure to shop around for rates and compare offers, including lender fees. While you can control these qualifying factors, mortgage rates are also influenced by outside forces, including economic conditions and inflation and the lender’s overhead. Be sure to look at quotes both from online and traditional brick-and-mortar financial institutions.

Is this a good time to refinance?

The average interest rate for a 30-year, fixed-rate jumbo mortgage refinance is 6.65%. When you pay your mortgage earlier, it frees up a lot of your income. You can allocate more of your cash towards emergency savings and retirement funds. Others choose to set aside money for their child’s college education, or invest in profitable business ventures. The Urban Institute notes that in October 2019, the share of 15-year fixed mortgages was only at 10.1%.

Some of the Services involve advice from third parties and third party content. You agree that Interest.com is not liable for any advice provided by third parties. To use some of the Services, you may need to provide information such as credit card numbers, bank account numbers, and other sensitive financial information, to third parties. By using the Services, you agree that Interest.com may collect, store, and transfer such information on your behalf, and at your sole request.

Instead of lowering their monthly payment, as a 30-year refinance would do, the new 15-year term increases this borrower’s payment by $460 per month. With a 15-year refinance, this homeowner would pay only $45,500 in interest over their new loan term. That’s less than half the cost of interest on a new 30-year loan — a total savings of more than $73,000. 15-year mortgage rates are usually lower than 30-year fixed rates, but the spread can change daily.

As price inflation persists, the Federal Reserve again moved aggressively at its November meeting. The Federal Reserve raised rates three-quarters of a percentage point for the fourth consecutive meeting, a strong policy move that continues to translate to rising mortgage rates. The average 10-year, fixed refinance rate is 6.05%, a decrease of 7 basis points from the rate observed over the previous week. With a new home loan, you are required to pay upfront fees of 3% to 6% of the loan amount.

However, with those elements in place, Wells Fargo’s deal offers a financially attractive path to homeownership. Your personal finances aren’t the only consideration that affects the mortgage refinance rates you’re offered. Your house’s value compared to your loan balance also factors into the decision.

As you can see, the big savings in interest costs you'll reap with that short 10-year term comes with the downside of a much larger monthly payment. We can only show you today’s 15-year mortgage rates as averages. The rate you actually end up paying will be determined by a large number of factors. In this example, the homeowner bought their home 2 years ago, and has an existing mortgage balance of $250,000. Their current mortgage rate is 4% and their monthly mortgage payment for principal and interest is $1,200. But you’ll be mortgage-free at age 60 – and you won’t be making payments during the best years of your retirement.

Mortgages require a monthly payment, but if you want to pay off your loan faster, making biweekly payments could be a good option. This means you’ll pay half of the principal and interest that’s due on your loan every two weeks, which evens out to 13 payments in a year instead of 12. But if you currently have a 30-year term and can’t afford higher payments, it might be better to stick with a longer term instead—though you’ll pay more in interest this way.

The Services may contain links to third party websites and services. Interest.com provides such links as a convenience, and does not control or endorse these websites and services. Refinance costs can change based on where you’re located, the lender you’re working with and a range of other factors. The general guidance, however, is that costs are around 2 to 5 percent of the loan’s principal amount. On a $300,000 mortgage, that comes out to $6,000 to $15,000 in closing costs. At the current average rate, you'll pay $634.70 per month in principal and interest for every $100,000 you borrow.

Since mortgage rates change daily, the lender with the best rates depends on the given day. To find the most optimal rate, it’s wise to check your rates with as many lenders as possible. Your DTI ratio is the amount you owe on monthly debt payments compared to your income.

No comments:

Post a Comment